Press Releases

PRISA Third Quarter 2016 Highlights

21-10-2016

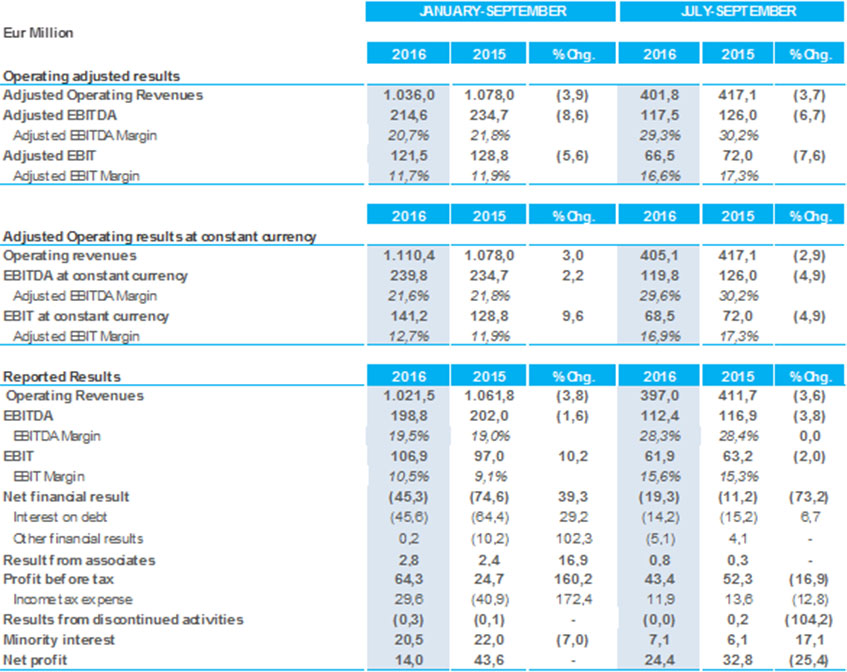

Adjusted EBITDA in 9M reaches 215 million euros (-8.6%)

(+2.2% in constant currency)

3Q consolidates first half trends:

- Spain advertising revenues grow due to digital develop and events.

- LatAm activities show growth in local currency in Education (+9.2%)

- Radio still shows weakness in LatAm mainly in Colombia and Chile.

- In Portugal, Media Capital shows operational improvement helped by growth in advertising revenue (+5.2%) and the sale of channels to third parties.

- The evolution of the exchange rate in 9M impacts negatively on revenues (-74million euros) and EBITDA (-25 million euros).

- Net bank debt stand at 1,587million euros as for September 30, 2016. Decline of 19 million euros in financial expenses in the period due to debt reduction.

EDUCATION

- During 9M South Area campaigns are totally finished. All campaigns have increased in constant currency, except for Brazil. This fall is offset by the growth in Peru by institutional bidding for primary and secondary.

- North Area campaigns (mainly Spain and Mexico) have occurred during 3Q, with sales returns still expected to be registered in 4Q. Spain's campaign has performed in line with expectations showing a slight drop compared to previous year due to minor novelties in 2016. Mexico shows growth in local currency

- Part of the institutional sales in Brazil are pending to be registered in 4Q.

- Digital Education Systems (UNO and Compartir) continue their expansion in Latin America, growing in number of students till reach 870,482. UNO and Compartir revenues grow by +10% in constant currency. Significant margin improvement of UNO.

- Adjusted revenues in constant currency grow by +5% and adjusted EBITDA grows by +8.3% in local currency (-4.9% in euros).

- Negative FX impact of 58 million euros on revenues and 23 million euros on EBITDA.

PRESS

- Press revenues grew by +2.1% in the period. The increase in digital advertising, events and promotions offset the decline of traditional advertising and circulation.

- Advertising revenues in 9M 2016 increase by +6.5%.

o Digital advertising increases by +20.2% (representing already 41% of total advertising revenues of the press) offsetting the fall in traditional advertising

- Circulation revenues moderate their drop (–3.4%) helped by the price raise.

- It is to highlight the operating improvement of As, which increases its EBITDA +9.5% (+0.4 million euros) consolidating its global branding strategy, with significantly growth of unique users in the different countries in which it operates.

- As of September 2016, an average of 88 million of unique browsers and 19.2 millions of unique users (as of August 2016, latest data available) has been registered.

- Press adjusted EBITDA increased by +16.6% over the same period last year to reach 7.5 million euros.

RADIO

- Advertising in Spain falls by -2.9% in 9M 2016, moderating its drop in Q3 (-0.4%). Local market continues to be the most affected market showing declines of 3% in the period

- According to the latest EGM, Radio in Spain remains the clear leader in both generalist and musical.

- In LatAm, adjusted revenues fall in local currency, with drops of –11.1% in Colombia and of –2.3% in Chile, reflection of the macroeconomic and specific difficulties of the advertising sector faced by both countries.

- Adjusted EBITDA in constant currency falls by 11.2 million euros to reach 32.1 million mainly explained by the LatAm performance.

- Negative FX impact is -14.5 million euros on revenues and -2.6 million on EBITDA.

MEDIA CAPITAL

- Total advertising revenues of Media capital increase by +5.2%.

- TVI shows a revenue increase of 1%. The growth of advertising revenue and channels sale to third parties offset the fall in added value calls:

o Advertising grows by +4.8% in TVI.

o Added value calls continue with significant falls (–4.2 million euros).

o The distribution of TVI channels in different pay platforms has a growth of 2.2 million euros.

- Radio improves its revenues 5.1% and EBITDA by +3% (+0.1M€).

- Adjusted EBITDA grows by +2.5% (+0.6 million euros), versus same period last year.

CONSOLIDATED P&L

During 9M 2016, excluding extraordinary items and exchange rate impact:

- Operating revenues grows by 3%

- Adjusted EBITDA grows by 2,2%

It may interest you