News

PRISA first half of 2014 highlights

24-07-2014

PRISA FIRST HALF OF 2014 HIGHLIGHTS

Adjusted EBITDA at constant currency (112 million euros) increases by 12.7% in the first half of the year (+ 5.4% in 2013 and +14.7% in 1Q2014)

- Improvement in the evolution of advertising in Spain and Portugal

- Solid growth in Latin America in local currency (in Santillana and Radio)

- Cost reduction and control of capex in all areas of the Group

Focus on the execution of the refinancing plan:

- Disposal of "Ediciones Generales" Business , sale of 3.69% stake of Mediaset Spain, debt by back at discount (165 million canceled with 121 million), agreement to sell 56% of Canal+ to Telefónica

- Capital increase of 100 million Euros, according to certain banks to buy back 600 million euros of debt at a discount of at least 25%.

The net result reaches -2,163 billion euros by the previously announced accounting impacts arising from the sale of Canal +.

Advertising in Spain and Portugal shows an improvement in the second quarter of the year

- The advertising market in Spain fell by 10.1% in 2013, with an important quarterly improvement (from -16.8% in 1Q to -1.7% in 4Q). In 1Q 2014, the Spanish ad market fell by -1.1% and 2Q the market grew by 4.3%

- In Spain, advertising Revenues in 1Q 2014 fall by -1.5% (-6.5% 1Q; +2.6% 2Q)

- In Portugal, advertising Revenues in Media Capital grow by 16,7% in 1H 2014 (+3,1% 1Q;26.4%2Q)

Latin America activities show solid growth in local currency but negative FX impact, that is diluted in second quarter

- Solid growth in local currency in Education (+6.12%) and Radio (+12.36%) excluding the impact of the change in consolidation perimeter

- Negative impact from FX evolution that moderates in 2Q and reaches 55,5 million Euros in 1H 2014 revenues, 15.4 million at EBITDA level versus 47.6 and 15.8 in 1T 2014

- 81% EBITDA of the Group from this area at constant currency

The Group continues its transformation

- Adjusted digital advertising grows by 13%

- In the press division, digital advertising represents 29% of advertising revenues

- Average unique browsers to the Group’s web sites grows by +19% reaching more than 88 million

Digital education systems continue their development in Latin America, increasing the number of schools and pupils reached and improving margins.

Opex and capex control continues

- Fall in all operating expenses of 36.2 million euros

- Adjusted personnel expenses fall by 25.4 million Euros (-11.6%)

- There has been renewed the entire collective agreements and has reached agreements to reduce employed workers in several areas

- Capex reduced to a minimum to cannel resources to growth areas, mainly Santillana

The Group continues with its focus on the execution of the refinancing plan

- Sale of the Trade Publishing Division (Ediciones Generales)

- Sale of the 3.69% of Mediaset Spain.

- The funds obtained from the sale of the stake in Mediaset Spain (121 million) were used to the repurchase of debt by auction at a price of 72.38%

- Sale of 56% stake Canal + to Telefonica for an initial amount of 750 million Euros.

- The total net debt of the Group as of June 30th amounts to 3,225.13 million Euros.

- Agreement with certain banks to repurchase 600 million of its debt (included the 100 million of capital increase) with a minimum discount of 25% until 31 December 2014.

Results by business division

Education

- In 1H 2014 almost all the campaigns from south Area have been closed showing good performance in local currency.

- The Campaigns of Spain, Mexico and the institutional from Brazil are in placement (Spain and Mexico) and promotion (Brazil) phases.

- In Spain 1H 2014 there is a delay in sales compared to 2013 results of 14.5 million Euros, due to the difficulties of implantation of the new education law that is not following the same pace in the different regions. It’s expected a correction of the delay in the coming months and the completion of the campaign with growth compared to 2013.

- Digital education systems (UNO and Compartir) continue their development in Latin America improving their profitability.

- The adjusted revenue in local currency increased by +1.2% (Spain -29.9% and Latam +4.4%): Brazil (-0.7%), Chile (+13.9%), Argentina (+29.9%), Ecuador (+37.2%) Central North America (+21.3%, Central South America (+38.7%). Exchange rate has a negative impact on revenues of 45,4 million in Santillana 1H 2014.

- Adjusted EBITDA grows by 5.4% in local currency (-16.4% in Euros), within FX impact of 13.2 million euros.

Radio

- Advertising in Spain grow by 0.9%, showing a clear improvement in the 2Q (-2.9% 1Q;+3.9%2Q)

- Advertising in Latin America grows in local currency in all countries.

Reported results are impacted by:

- FX has a negative impact in radio revenues of 8.4 million Euros

- Change in consolidation of Mexico & Costa Rica,whichare integrated through equity on the back of an international accounting law change, adopted by the EU and which impacts since January 2014.

-

- Excluding this impact, advertising revenues in Radio Latin America would have grown by 12.8%.

- Adjusted EBITDA in Radio reached 29.85 million Euros (+43.6%) in 1H 2014, being the FX impact 1.6 million Euros.

Press

- Printed advertising revenues fall by -4.1%,(El País - 7,4% y AS +11,7%) with a significant quaterly improvement (-10,6%1Q; +1,4%2Q).

- Traditional advertising revenues fall by 10.8% which are partially compensated by the excellent performance of the Digital advertising revenues which grow by 17.3% and already represent 28.9% of the division’s advertising revenues. We highlight the strength of AS where digital advertising revenues already represent over 50% of the total, with a growth of +24.6%.

- Circulation revenues fall by -14.7%

- Strong growth in Other Revenues (43.7%), mainly promotions (+112.2%). In 1H revenues deductions of 4.7 million have been generated. This amount hasn’t been registered as revenues versus 0.8 million registered in 1H 2013.

- Adjusted EBITDA in press reaches7.3 million Euros (-35.6% compared to 1H 2013)

Media Capital

- Advertising Revenues increase by +16.7% in 1H 2014(1Q +5.3%:2Q +26.4%). Very good performance both on TV (+17.4% in 1H 2014) as well as on radio (+9.1%).

- Adjusted EBITDA reaches 19.4 million Euros and grows by 9.7 % on the back of the stability of Revenues and a strong effort to control the costs.

Sale of Canal+

On June 2014 the contract to sell 56% stake of Canal+ with Telefonica was formalized at initial amount of 750 million euros:

- The price is subject to customary adjustments in such operations until the closing of the transaction.

- The operation is already approved by the representative panel of the financing banks and is subjected to the authorization of the competition authorities.

- It generates an accounting loss in the consolidated accounts of Prisa of 2,064 million euros and 750 million in the individual accounts, This loss in the individual generates an asset imbalance, although the refinancing agreement provides a mechanism for automatic conversion of a portion of section 3 of the debt into equity loans for a sufficient sum to compensate for this asset imbalance.

- The results of this transaction are presented in the consolidated income statement under "Result from discontinued operations" and the assets and liabilitiesas "Non-current assets held for sale" and "Liabilities associated with non-current assets held for sale".

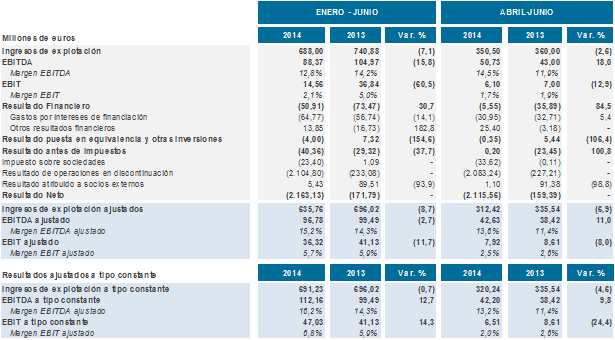

Consolidated P&L

The comparison of the results of the first half of 2014 and 2013 is affected by extraordinary items recorded under both revenues, expenses, amortizations & provisions. To conduct a homogeneous comparison, we are presenting a profit and loss account adjusting these extraordinary items:

During the first six months of the year, excluding extraordinary items and exchange rate:

- Operating revenue fall by -0.7%.

- Adjusted EBITDA grows by 12.7%.

- Significant improvement of margins is achieved

It may interest you