News

PRISA first quarter 2016 highlights

09-05-2016

Net bank debt has been reduced by 48 million euros in the first quarter of 2016. In April 2016 approval was agreed for the issuance of bonds that are convertible into shares at 10 euros per share – which will reduce debt and strengthen capital tby a total of 100 million euros in the second quarter.

Group advertising revenues in Spain had fallen by 3% in Q1 (Radio saw a drop of 6.9% while Press saw growth of 3.8%) when compared with Easter 2015, which this year fell in March. In April, this trend was reversed. In Portugal, advertising has started the year with 8.6% growth; (TVI + 8.2% and Radio + 13%).

The Group's operations in Latin America show growth in constant currency

- Education, Southern Area campaigns have performed positively (+ 19%).

- Radio revenues grew 3%, with notable results in Colombia and Chile (+ 4.1% and + 2.9% respectively).

- The exchange rate has had a significant negative impact during the quarter, mainly affecting Santillana. The negative effect on earnings is 49 million euros (42.6 in Santillana and 5.5 in Radio) and on EBITDA is 22 million (21.6 in Santillana and 0.7 in Radio). In the first quarter, the exchange rates to have the greatest impact were: Brazilian real at 4.34 euros compared to 3.16; the Argentine peso at 16.48 euros compared to 9.66 euros, and the Peruvian sol at 3.83 versus 3.43, compared to the first quarter of 2015.

The Group continues apace with its digital transformation. Here, earnings reached 56.7 million euros (+ 0.7% in euros, + 12% local currency).

- Digital Learning Systems (UNO and Compartir), continue to grow, increasing the number of students in Latin America to a total of 873,064 (+ 8%). Earnings in constant currency grew by + 15.3%.

- Digital advertising increased by 26.7%, reaching 12.2 million euros in the quarter. For digital press, advertising continues to grow and now accounts for 40% of total advertising revenues.

- Monthly average unique browsers grew by 16.7% to 121 million.

Continued financial deleverage

- The Group’s net bank debt fell by 48 million to 1.612 million euros at March 31, 2016, compared to 1.660 million in December 2015.

- In February 2016, 65 million euros of debt were canceled through auction at a discount of 16.02%, with the remainder coming of the total from the sale of Canal +. In April 2016, approval was given for the issue of bonds that are convertible into shares at 10 euros per share, for a total value of 100 million.

Results by business unit

Education

- In Q1, campaigns take place in the Southern Area: Brazil, Colombia, Costa Rica, Northern Central America, Uruguay, Chile, Bolivia, Argentina, Paraguay, Peru and Ecuador: All campaigns have reported increased revenues in constant currency, except for Brazil and Chile.

- Peru stands out, with growth of + 125% (17 million euros) thanks to public tenders at primary and secondary level, which compensates for the poorer showing in Brazil and Chile compared to Q1 2015.

- Brazil fell by -7.4% in local currency (-33.3% in euros).

- Campaigns in the Northern Area (chiefly Spain and Mexico), take place in the second half of the year, and therefore figures for this quarter are not representative.

- Digital learning systems (UNO and COMPARTIR) continue their expansion in Latin America, and grew by 8% in number of students for a total of 873,000. UNO and COMPARTIR saw earnings up by + 15.3% in revenues (excluding the exchange rate).

- Adjusted income at constant exchange rates increased by + 19.1% and EBITDA was up by 28.6% in constant currency (-8.7% in euros).

- The exchange rate has had a negative impact of 42.6 million euros on revenues and of 21.6 million on EBITDA.

Radio

- Advertising in Spain fell by -6.9%, albeit with growth at a national level (+ 2.9%) and a fall at a local level (-10.4%).

- According to latest EGM figures, radio stations maintain their lead both for general-interest radio as well as for music radio.

- In Latin America, earnings rose in constant currency by + 3%.

- Adjusted EBITDA at a constant exchange rate for Radio was down by 2.3 million euros (-23%).

- The negative impact of the exchange rate is -5.5 million euros for earnings and -0.7 million for EBITDA.

Press

- Advertising revenues for the first quarter increased by 3.8%. Digital advertising grew by 26.1% (and already accounts for 40% of total advertising revenue of this business unit), offsetting the decline in traditional advertising (-5.6%).

- Circulation revenue slowed down its decline to just -4.1% due to cover price increases that took place in Q1, with consequent increase compared to 2015.

- In March 2016, press recorded an average 86.6 million unique browsers and 19.1 million unique users.

- Cost control has been maintained (-1.5% in adjusted expenses).

- Adjusted EBITDA for Press has become positive and amounted to 1.4 million euros compared to -0.7 million in Q1 2015.

Media Capital

- Total advertising revenue for Media Capital increased by 8.6%.

- TVI recorded revenue growth of 3.7%. The increase in advertising revenue and the sale of channels to third parties offset the fall in earnings from premium-rate phone calls:

- Advertising grew by + 8.2% in TVI.

- Premium calls continue to fall (-1.7 million euros).

- TVI channel distribution to different pay TV platforms has grown in the first quarter by 1.9 million euros.

- Radio saw EBITDA increase by 0.4 million euros.

- Adjusted EBITDA for Media Capital remains at 6.2 million euros.

Consolidated P&L

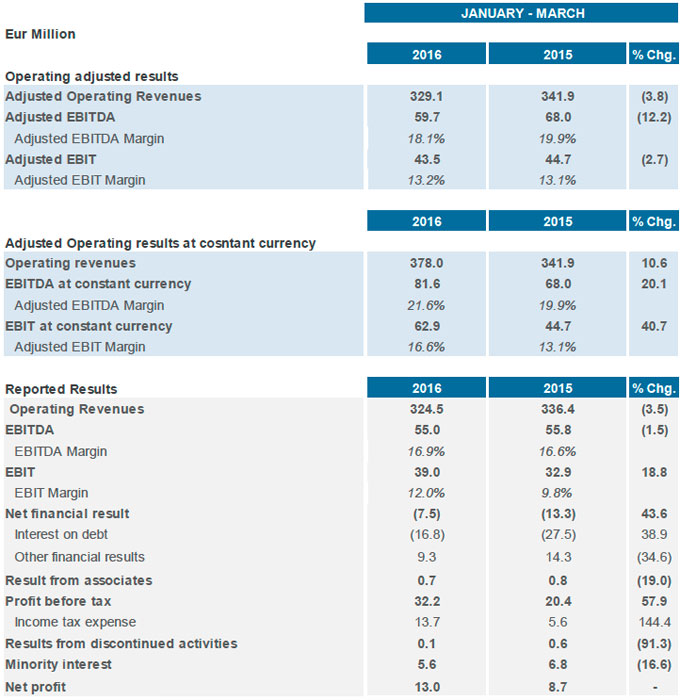

During 1Q 2016, excluding extraordinary items and exchange rate impact:

- Operating revenue at constant revenues grow by 10.6%

- Adjusted EBITDA grow by 20.1%.

It may interest you