News

PRISA returns to profitability 5.3 million euros net profit

26-02-2016

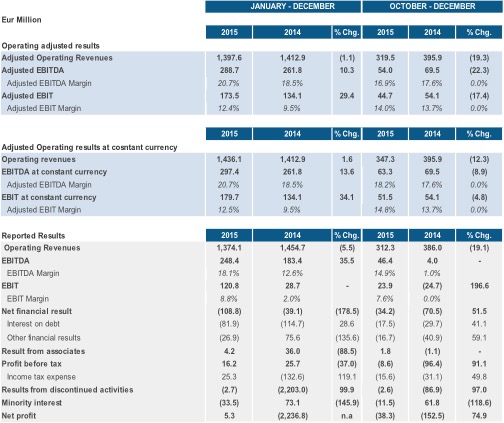

After overcoming years of crisis PRISA has returned to profitability in 2015, with a net profit of more than € 5 million and with a marked improvement across all its operations, both in Spain and in the Americas in local currency. PRISA has fulfilled its financial commitments ahead of schedule after making an enormous effort to cancel debt of more than 922 million euros this year.

Advertising in Spain shows recovery during 2015

- Advertising revenues of the Group in Spain increase by +6.4% in 2015 (+3.9% in 4Q)

- Radio in Spain grows by +8.1%.

- Press grows by +6.7%, (-4% offline; +27.1% online).

- In Portugal, Media Capital registers a minor growth in a context of a shrinking market. Advertising revenues grow by (+2.1%); (TVI +1.4% y Radio +9.1%).

LatAm activities show growth in local currency

- In Education, sales in LatAm, grow in local currency in the most important countries except in Brazil for being a low cycle year in institutional sales.

- In Radio LatAm, adjusted revenues remain flat by +0.3% in local currency, highlighting the improvement of Colombia during the last quarter (+8% in 4Q).

- FX evolution during 2015 has had a negative impact of -38.6 million euros on adjusted revenues and of -8.6 in EBITDA, mainly explained by the strong volatility of currencies in 4Q, in which FX has had a negative impact of 28 million in revenue and 9.3 in EBITDA.

The Group continues its digital transformation

- Digital transformation revenues increase by 20.7% and reach 193.5 million euros.

- Digital education systems (UNO and Compartir) continue their development in Latin America reaching 813,752 students (+28.8% YoY). Its revenues in local currency grow by +16.5%.

- Adjusted Digital advertising grows by 22% in 2015, reaching 51 million euros in the year:

- In Press, digital advertising continues growing and already represents 36.4% of advertising revenues.

- Average unique browsers of the Group’s web sites grow by 33.5% reaching more than 112 million.

Financial deleverage continues

- Canal+ sale was closed on April 30, 2015;

- Cancels 621 million with the funds received.

- Agreement for a resolution procedure related to 36 additional million.

- The final acquisition price amounts to 724 million euros, subjected to resolution of differences amounting to 29 million euros.

- 201 million euros debt reduction with a c. 22% discount with funds coming from Mediaset Spain stake sale.

- Capital increase of 64 million Euros fully subscribed by International Media Group at 10 euros per share.

- Total Group net debt reduced by 922 million to 1,660 M€ as of December 31st 2015, comparing to 2,582 million as of December 2014, fulfilling in advance the debt reduction commitments ( € 1,500 million) until 2018.

- In January 2016, a mandatory convertible bond issuance is agreed at 10 euros per share by swapping debt for a minimum of 100 and a maximum of 150 million euros.

- In February 2016 debt reduction has continued by canceling 65 million euros by auction at a discount of 16.02%..

Results by business division

Education

- In Spain, the 2015 Campaign has grown significantly explained by the grade of the adoption of the new law and a good commercial development. Revenues grow by 20% and EBITDA by 54%.

- In LatAm, Campaigns have had a positive evolution in the majority of countries in local currency. It is noted that:

- Brazil, whose revenues fall by -8% in local currency due to the low cycle year in institutional sales but with a good performance in the regular campaign.

- Argentina, which has grown by +56.7% driven by the institutional sales.

- Mexico, which grows 1.5% in local currency despite the lack of renewal of its programs

- Digital Education Systems (UNO and COMPARTIR) continue their expansion in Latin America, growing by +28.8% the number of students to 813,752. UNO System reaches EBITDA of 20.6 million euros in 2015.

- In total, adjusted revenues in local currency have increased by +3%.

- Adjusted EBITDA grows by +10.9% in local currency (+8.6% in euros).

- Negative FX impact of 28.6 million euros on Santillana revenues and 3.5 million euros on EBITDA during 2015.

Radio

- Advertising in Spain grows by +8.1% (6.4% in local and 9.3% in national).

- Strong operational improvement in Spain, which increased its adjusted EBITDA by +72.4% in 2015 reaching 29 million euros.

- Radio LatAm adjusted revenues in local currency remain practically flat (+0.3%) in 2015 versus 2014.Colombia accounts for 54% of adjusted revenues from international radio and has had a growth of + 8% (local currency) in 4Q of the year.

- Adjusted EBITDA in Radio in 2015 reached 80 million euros at constant currency (+21% compared to 2014) or + 13.8% in euros

- Negative FX impact (-8.4 million euros on revenues and in -4.8 million on EBITDA), mainly in Colombia.

Press

- Advertising revenues in 2015 increase by +6.7%.

- Digital advertising increases by +27.1% (representing already 36% of total advertising revenues of the press) offsetting the fall in traditional advertising (-4%).

- As of December 2015, an average of 81.7 million of unique browsers and 20.7 million of unique users has been registered.

- Cost control is maintained (-6.5% in adjusted terms)

- Press adjusted EBITDA reaches 16.5 million euros in 2015 (+12.8%).

Media Capital

- Advertising revenues increase in 2015 by +2.1% (+5.1% in 4Q) despite a market a contraction of the market that Portugal is going through. Tv maintains a growth of +1.4% and Radio registers an improvement of +9.1%.

- Added value calls registered a significant drop (-38.1%) down to 2011 level.

- The distribution of TVI channels in different pay platforms have had a growth of + 33.8% as of December 2015.

- Adjusted EBITDA reaches 42 million euros (-3.8%)

During 2015, excluding extraordinary items and exchange rate impact:

- Operating revenue at constant revenues grow by 1.6%

- Adjusted EBITDA grow by 13.6%.

- Substantial improvement of margins.

It may interest you