News

PRISA: Stability in Revenue (-1,3%) and EBITDA (-1,7%)

28-02-2012

• Recurrent revenues reached 2,714.16 million Euros (-1.3%).

• Recurring EBITDA margin reached 18.2%, in line with that of 2010.

• The Pay TV business grows in net subscribers, with a stable ARPU (41.1 euros) and a lower churn ratio (13.6%). It reaches an EBITDA of 186.77 million Euros (+12.5% adjusted by non-recurring items).

• Santillana grows by +12.2%.

• The revenues in the Digital activity increase by 6.7%. 63.7 million average number of unique monthly browsers (+25.3% vs 2010).

• Latin America revenues grow by 15.9%, and account for 24.3% of those of the Group. EBITDA from this region accounts for 38.6% of EBITDA of the total.

• Advertising revenues in Spain and Portugal reach 498.1 million Euros and represent 18.3% of PRISA’s revenues.

• Cost restructuring: The Group´s management has accepted a reduction of 7% of his fixed salary.

• The efficiency plan has been completed: total investment of 94.8 million Euros for annualized savings of 64.5 million Euros.

• The financial debt has been refinanced, extending its maturity to 2014/15. The Group has now time and financial flexibility to focus on the improvement of its businesses. The refinancing agreement activated the mechanisms for the conversion of 75 million warrants by the Polanco family, Mr. Martin Franklin and Mr. Nicolas Berggruen, for a total amount of 150 million Euros (at a price of 2 Euros per share).

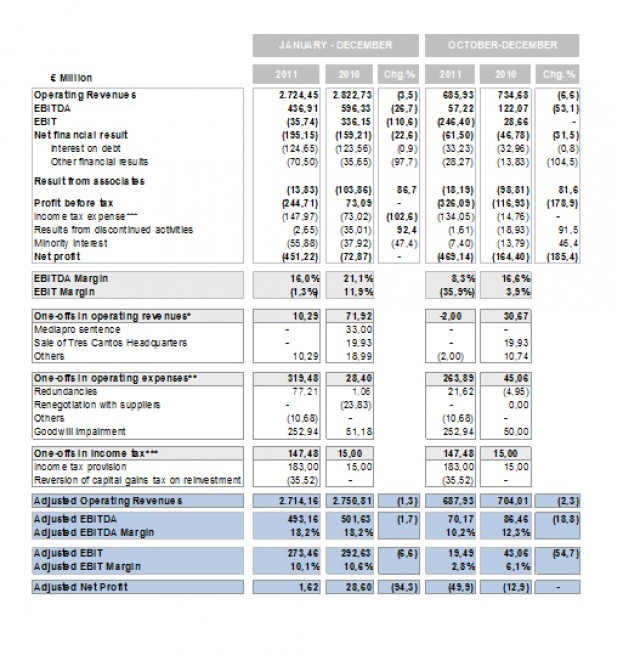

PRISA today announced its financial and operational results for the year 2011. In the period, the Group achieved revenues of 2,724.45 million Euros and an EBITDA of 436.91 million Euros. Adjusted EBITDA margin was stable (18.2%).

The Chairman of the Executive committee of the Board and CEO Juan Luis Cebrián declared: “These results demonstrate the operating resilience of our businesses even in an environment with extreme economic cycle weakness. Santillana and the Pay TV business are examples of how it is possible to grow in the most adverse circumstances”. He added: “We have undertaken a strong cost reduction effort. This, together with our increasing presence in Latin America, has partly mitigated the fall in the advertising markets of Spain and Portugal. The international revenues of PRISA account already for more than 32% of the total”.

“Following a basic prudence criterion and especially given the very difficult situation that Portugal is going through, in our 2011 results, we have registered a provision for goodwill impairments of 252.94 million Euros. We have also registered provisions in our Income tax for 183 million Euros, to face a potentially negative outcome of several fiscal matters still under discussion, relative to tax deductions on exporting activities. However, we are still confident that the court will rule in our favour”.

The Chairman of the Executive committee of the Board and CEO ended by highlighting that the agreement with the banks has provided PRISA with the financial flexibility which will allow it to focus its efforts on improving the operating performance of its businesses.

In line with the cost reductions efforts, 92% of Group´s management has accepted, voluntarily and indefinitely, a 7% reduction of his fixed salary.

2011 highlights

- Market conditions remain stable in all business areas except advertising and books consumption in general publishing (Ediciones Generales), which continue to be affected by weak macroeconomic conditions in Spain and Portugal.

- In the Audiovisual division, revenues total 1,241.19 million Euros, and EBITDA 234.69 million Euros. EBITDA margins, adjusted for extraordinary items increase by 3.2 percentage points to 18.3%. At the end of 2011 pay TV has 1.84 million subscribers, of which 82,247 come from other platforms (other to DTH). Net adds of DTH fall by 16,671 compared to a fall of 72,949 in 2010. ARPU remains above 41 Euros on average. Churn rates continue to fall to 13.6%compared to the 15.8% of 2010. iPlus subscribers increase in almost 65% in the year and reach 503,202.

- In Education, revenues (720.39 million Euros) grow by 12.2% given the strong performance of the education campaigns in Latin America (we highlight Brazil with a growth of 24.1%) and the education campaign in Spain, which grows by 8.6%. Adjusted EBITDA reaches 173.70 million Euros, 4.4% above the previous year.

- Revenue in the Radio division (376.77 million Euros) falls by 7.1% from 2010. International radio advertising grows by 5.4%, partly compensating worse performance in Spain, which falls by 10.3%. Adjusted EBITDA totals 87.02 million euros (-19.7% vs 2010) and the adjusted EBITDA margin is 23.1%.

- Revenue in Press reaches 390.01 million Euros, down by 7.2% from 2010. Adjusted EBITDA totaled 54.84 million Euros.

- The Digital division achieves a monthly average of 63.7 million unique browsers in 2011, a 25.3% increase vs 2010, thanks to strong growth recorded by As.com, El País.com and CincoDías.com.

- Total advertising revenues reach 620.06 million Euros, down 8.0% from 2010 and represent just 22.8% of those of the Group.

Consolidated earnings

The comparison of 2011 and 2010 results is affected by extraordinary items recorded under revenue and expenses both in 2011 and 2010. Therefore, to conduct a homogeneous comparison, we are presenting a pro forma profit and loss account adjusting the extraordinary items.

As for the exclusion of Cuatro from the consolidation perimeter, 4Q2010 results were already presented with Cuatro included as a discontinued activity, so in this sense the results of both years are perfectly comparable.

* Extraordinary items for revenues are recorded correspond in 2011 mainly to the sale of Canal Viajar, and are registered in the audiovisual division. In 2010 they correspond to the Mediapro sentence and the sales of the Tres Cantos headquarters, Sogecine and Sogepaq.

** Extraordinary items for expenses correspond to redundancies from the efficiency plan which PRISA is undertaking since December 2010 as well as other items such as the FC Barcelona sentence. In 2010 they correspond to the redundancies from the efficiency plan and renegotiations with suppliers which are registered in the audiovisual division.

In addition, although only impacting at EBIT level (not at EBITDA) there are impairments of the Media Capital goodwill (219 million Euros) and that of PRISA Brand Solutions, advertising marketer (33.34 million Euros), which are registered at group level.

*** Following a prudence criteria, Prisa has registered a provision of 183 million Euros to face a potentially unfavourable resolution in certain matters under discussion, mainly the tax deduction for exporting activities.

It may interest you