Press Releases

PRISA reports adjusted EBITDA of EUR 230 million for 2017

28-02-2018

- Education closes 2017 with robust performance, driven by Latin America which saw revenue climb by 8%

- Radio improved profitability and Press strengthened its digital lead

- PRISA has set in place a long-term sustainable capital structure

- New Governance and new management team

- Focus on growth and creation of value.

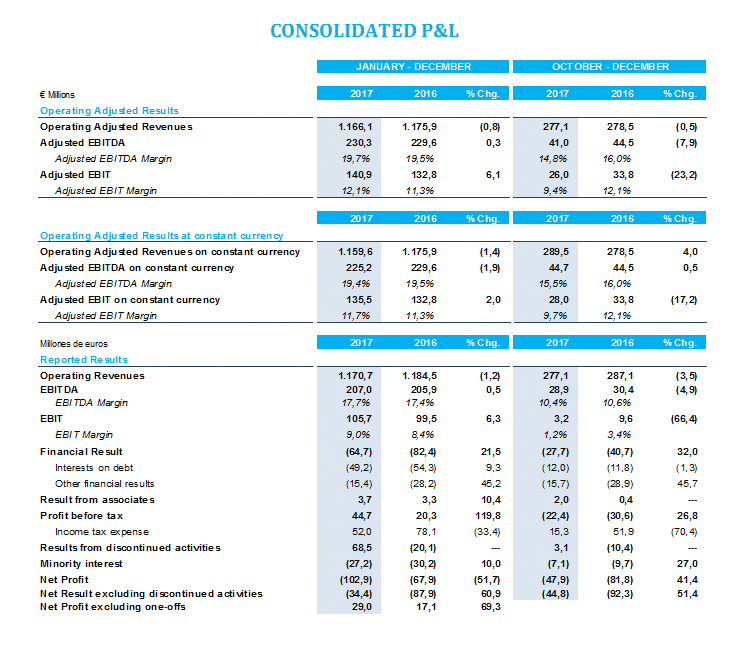

PRISA Group has reported adjusted EBITDA of 230 million euros for 2017, representing an increase of 0.3% compared to 2016, as communicated to the National Securities Market Commission (CNMV). Net income, excluding extraordinary items and operations, amounted to 29 million euros. The net result recorded a negative balance of 102.9 million due to write-downs affecting different assets of the group, with losses recorded from the sale of Media Capital and the impact of extraordinary taxation resulting from the application of the new companies law.

Strong performance for the education business has been key for PRISA in 2017. Santillana remains market leader for education, with total revenues up by 3.7% over the previous year, and adjusted EBITDA at 187 million euros, compared to 180 million in 2016.

In Latin America, revenue rose 8%, with notably strong performance in Brazil where there was growth of 23%. Digital learning systems (UNO and Compartir) continue to expand, with student numbers up by 7.5% to total 932,606.

Radio saw profitability up by 1.2%, in constant currency, to reach 47 million euros. PRISA stations in Spain consolidated their leadership for both general-interest radio and music radio, according to the latest EGM figures, and advertising was up by 1.4%. In Latin America total revenues for PRISA Radio reached 95 million euros.

In Press, El País maintains its absolute lead in Spain, with an annual average market share of 41% according to the latest data from OJD. It has 108 million unique users, which puts it in first place for news sites in Spanish and tenth overall in the world ranking. In 2017, AS became the world’s most widely read Spanish sports newspaper, according to ComScore. This owes much to growth in Latin America, where AS is leader in Colombia, Chile and Mexico. There was also notable growth in Spain, where AS.COM is visited by more than 12 million users, a 28% increase compared to 2016.

Digital advertising revenue grew 3% and now accounts for 46% of total advertising revenue.

Adjusted EBITDA for Press was 12.5 million euros. The increase in digital advertising has failed to offset the decline in traditional advertising or match the impact of the 40th anniversary and Euro 2016 in the previous year, but is helped somewhat by strong cost control.

At the start of 2018, PRISA has set in place a long-term sustainable capital structure following the refinancing of the debt, which does not foresee repayments until 2022. The capital increase was a resounding success and amounted to 563 million euros, and demand for shares was oversubscribed by 7.6 times.

PRISA also embarked on this new era with a new board of directors, with a majority of independent members, and new management teams, at both corporate level and at the level of Press and Radio.

PRISA's financial stability now allows it to concentrate its efforts on business development, where it is set to invest approximately 113 million euros, and on generating value.

PRISA’s ongoing commitment to digital transformation has paid off with an increase in digital revenues of 13%, for a total of 223 million euros. Such revenues now account for 19% of total Group revenues.

Other significant figures by business unit

In the area of education

- Campaigns in the southern area saw revenues up by 14.5% (+ 11.7% at constant currency).

- In the north, campaign revenues are down 7.7%, mainly due to the performance in Spain whose fall, as expected, is due to the absence of new educational materials.

- Norma's contribution to revenue in 2017 was 32.6 million euros, with very satisfactory performance after full utilization of synergies, triggering a positive contribution to EBITDA.

- The exchange rate has had a positive impact in 2017, thanks chiefly to Brazil. The positive impact was of 8.3 million euros in revenues and 5.8 million euros in EBITDA.

In the radio business

- Adjusted income reached 281 million euros, compared with 301 million in the same period last year (-6.8%). 2016 figures included GLR Networks and RLM, which have since been sold and which contributed, in the period, 7.2 million euros. Extraordinary events in 2016 had amounted to 7 million euros. Discounting these effects, revenues would have registered a fall of 2%.

- In Spain, adjusted earnings for Radio totaled 180 million euros in 2017, compared to 183 for the same period the previous year.

- In Latin America, adjusted income was 94.6 million euros versus 98.9 million for the same period of 2016. Excluding the effect of the sale of GLR Networks, revenues have remained stable.

- The impact of exchange rates was negative, down 1.5 million euros in revenue and 1 million in EBITDA.

- Music: Revenues were down, due chiefly to divesting RLM and compared to extraordinary events held in 2016.

In the Press Division

- Revenues for Press were down by 8.1% to 221 million euros.

- Advertising revenues totaled 106 million euros, down 8% (4%, excluding extraordinary impacts). Revenue from digital advertising grew by + 3% in the period and now accounts for 46% of total advertising revenue for this division. Revenues from non-digital advertising fell by 15%

- Events reported revenue of 7 million euros in 2017 compared with 8.6 million euros in 2016. The downturn is mainly due to a fall back after the wide range of events held in 2016 for the 40th anniversary of El País. (15% growth excluding this impact).

It may interest you